Dinero Checking

The perfect first checking account for teens

No minimum balance requirements

No monthly service fees

Unlimited debit card rewards

Mobile wallet support

Free instant-issue debit card

Unlimited free ATMs worldwide

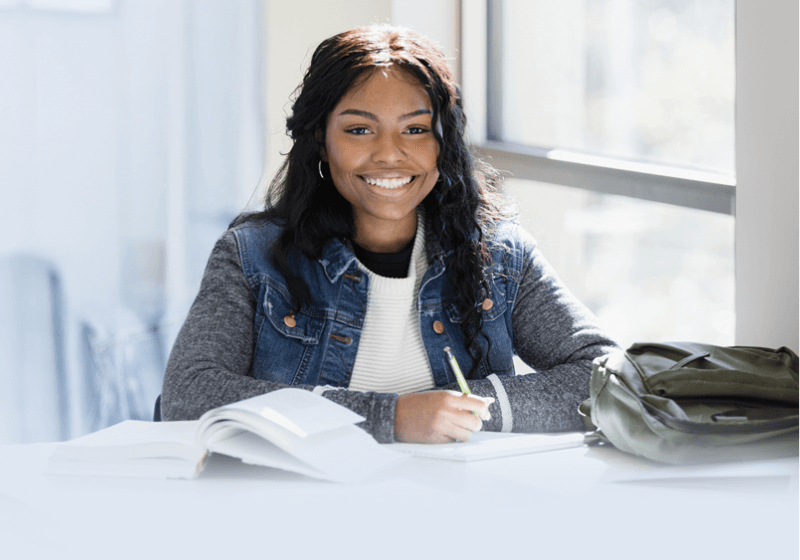

Carl R. Young Memorial Scholarship

Every spring, Dinero Teens members who are graduating juniors or seniors are eligible to apply for a chance to win one of four $2,500 scholarships. Named in memory of our longtime board member and volunteer, Carl R. Young, our hope is that this scholarship helps Advancial's young members succeed the way that Carl helped our credit union for so many years. Carl’s dedication and commitment to Advancial and our members was a vital part of our growth and success. His wisdom and long-term perspective helped guide and shape Advancial through many transitional moments in our history, and with this scholarship we honor his contributions and his memory.

The 2025 Carl R. Young Memorial Scholarship is now closed for submissions. Winners will be notified soon.

Dinero Visa®

Frequently Asked Questions about Dinero Checking

To activate your card in cuAnywhere® or the Advancial Mobile App:

- Log in to cuAnywhere® Online Banking or the Advancial Mobile App

- Select Card Management > Card Maintenance

- Click Card Activation and follow the steps provided

- Log in to cuAnywhere® Online Banking or the Advancial Mobile App

- Select Card Management > Card Maintenance

- For cuAnywhere, click PIN Management

- Select the card in which you’d like to change your PIN and click Continue

- Enter your new PIN and click Save

- For the Advancial Mobile App, click PIN Set and follow the same steps mentioned above

To lock your card in cuAnywhere® or the Advancial Mobile App, follow these steps:

- Log in to cuAnywhere® Online Banking or the Advancial Mobile App

- Select Card Management > Card Controls

- Select or add the card in which you’d like to lock

- For cuAnywhere®, click Lock or Unlock the card

- For the Advancial Mobile App, click the icon so that it shows Locked

- If you find your card, simply use the same steps to unlock it and begin using it again

- Log in to cuAnywhere® Online Banking or the Advancial Mobile App

- Select Card Management > Card Maintenance

- For cuAnywhere®, click Block Lost/Stolen Card

- For the Advancial Mobile App, click Card Blocking

- Select the card in which you’d like to block and click Block or Submit

You may also contact your local branch, our Member Service Center or order them in cuAnywhere® Online Banking.

To order through cuAnywhere:

- Log in to cuAnywhere® Online Banking

- Select Manage > Order Checks

- Select the account in which you’d like to order checks

- Fill out the information on the check order page you’re redirected to

Dinero Teens: Claim Your Cash — Don’t Leave Free Money Behind!

Dinero Teens: How to Ask for a Raise or Negotiate Your Salary

Dinero Teens: How to Build Credit Without Wrecking It