New Tax Perk on Car Loan Interest

If you’re thinking about refinancing or buying a new car, SUV, or truck, there’s a new federal tax benefit worth knowing about.

For tax years 2025 through 2028, eligible taxpayers may be able to deduct up to $10,000 in interest paid on qualifying new vehicle loans— even if you take the standard deduction. This guidance was recently clarified by the Internal Revenue Service.

Here’s How It Works

You may qualify if:

- Your auto loan was originated after December 31, 2024

- The vehicle is new and purchased for personal use

- The vehicle is a car, SUV, pickup, van, minivan, or motorcycle under 14,000 pounds

- The vehicle’s final assembly occurred in the U.S.

- The loan is secured by the vehicle (not a lease)

The deduction is capped at $10,000 per year and may be reduced or unavailable depending on your modified adjusted gross income (MAGI).

What You’ll Need at Tax Time

If you qualify, your lender will provide information about interest paid on your loan, and you may need your vehicle’s VIN when filing your return. You can verify final assembly using the NHTSA VIN Decoder.

As always, consider consulting a qualified tax professional to understand how this may apply to your situation. At Advancial, we're here to help you stay informed and plan with confidence.

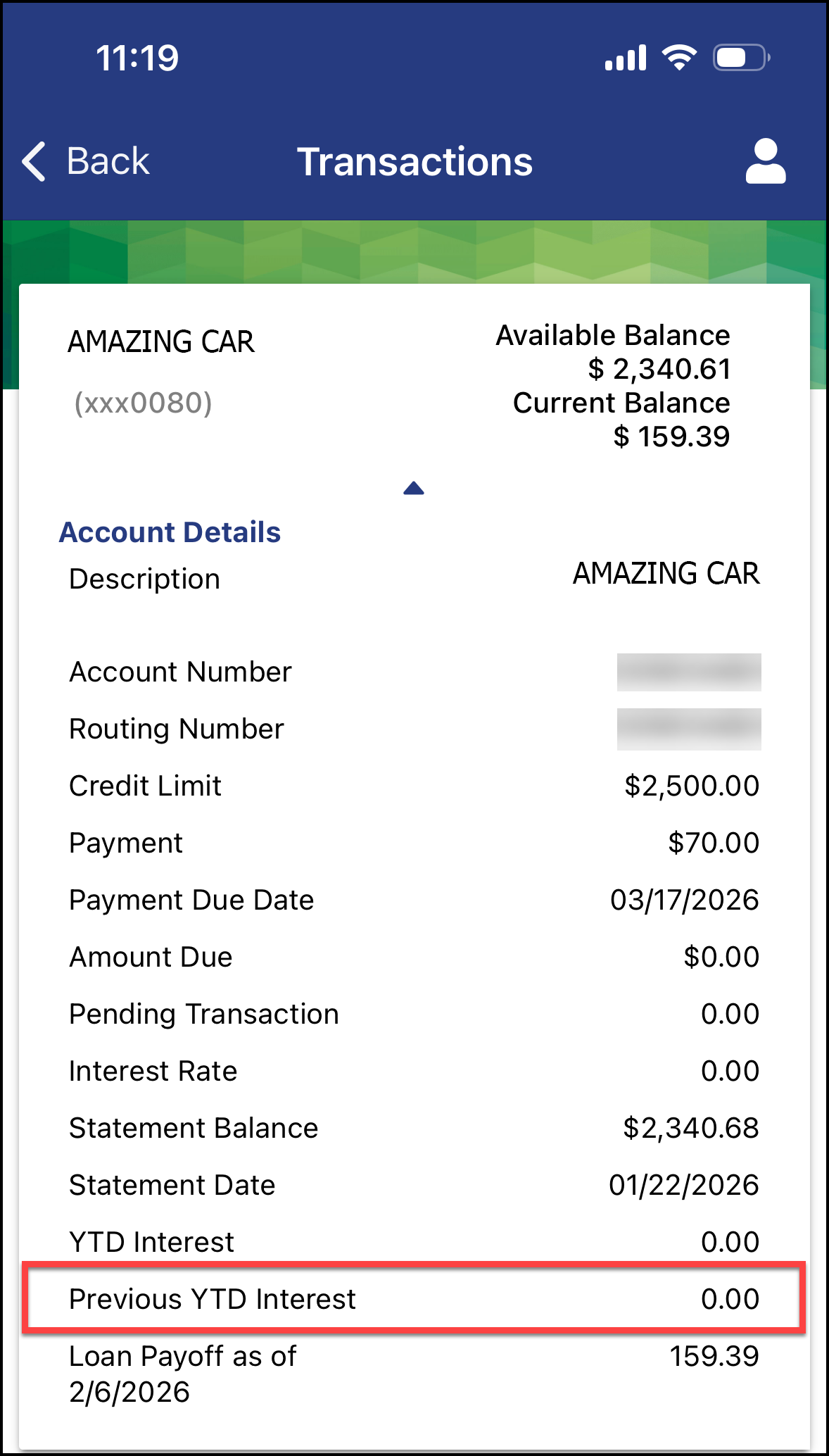

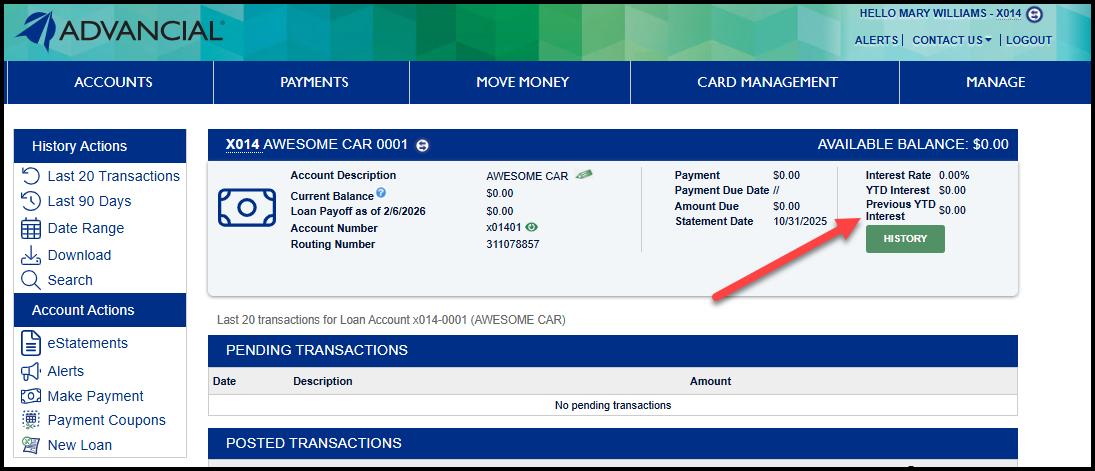

Where to Find Your Previous YTD Interest

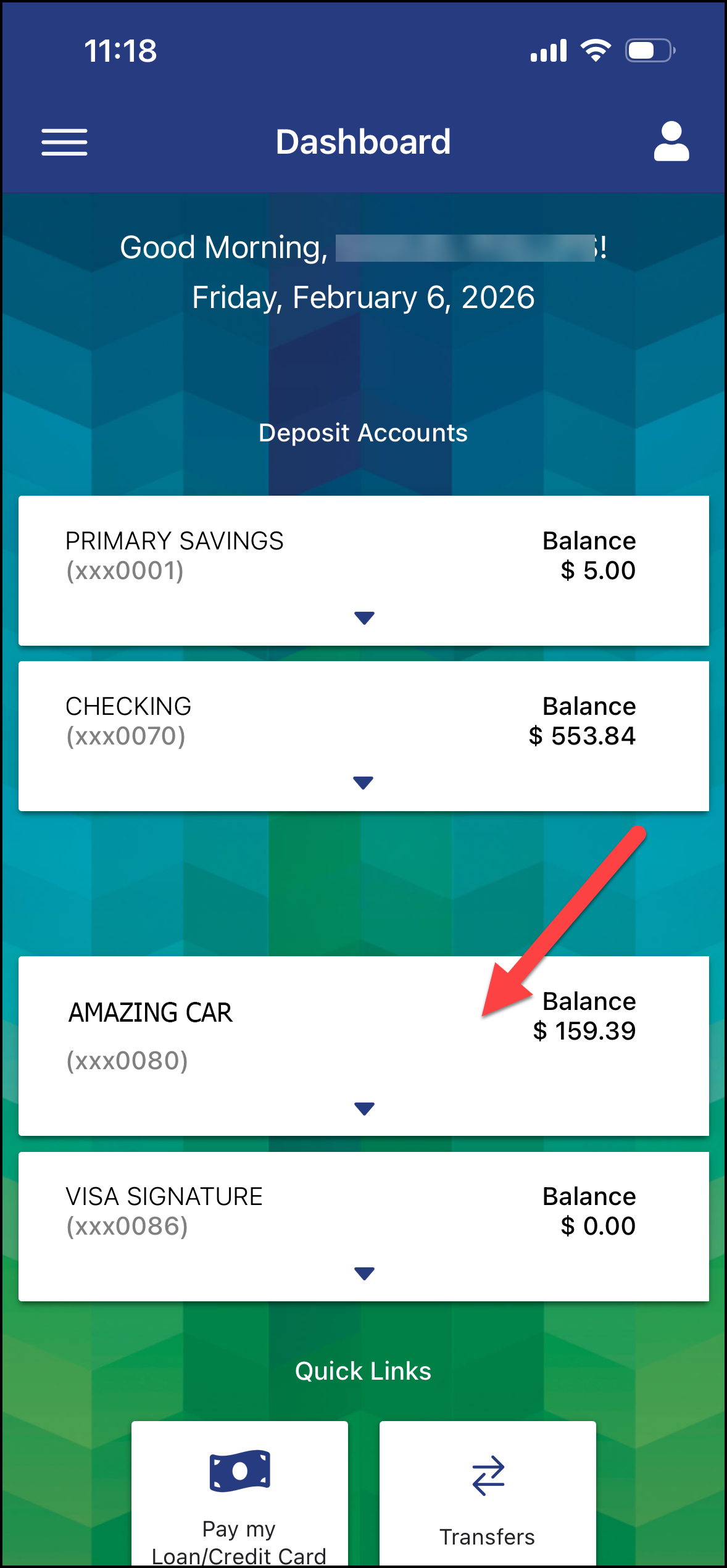

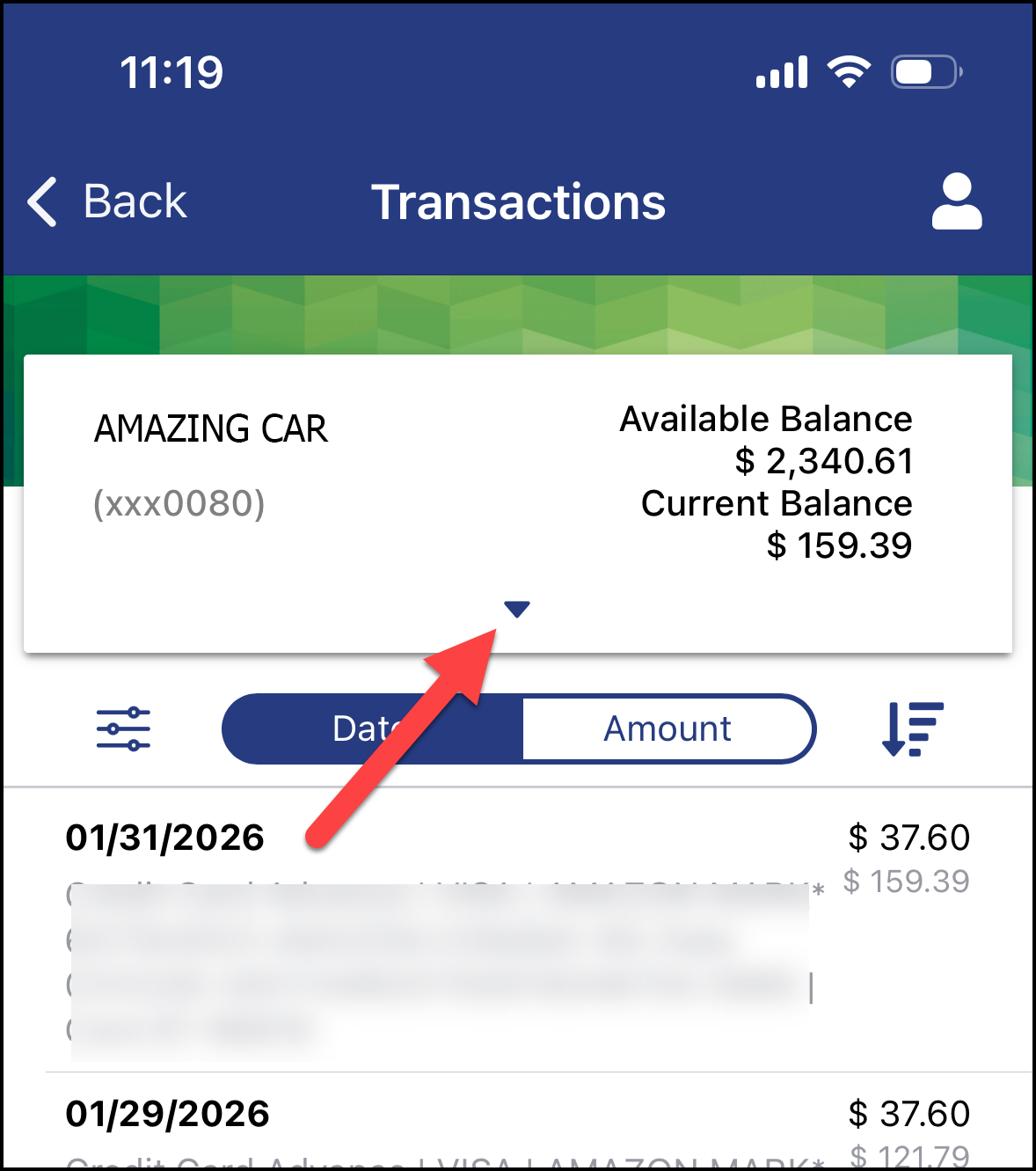

1. Select your loan

2. Tap the down arrow to expand the menu

3. Locate the "Previous YTD Interest"