Safeguard Your Finances When Shopping Online

What’s not to love about shopping online? After browsing and a couple of clicks, merchandise is delivered to your door. Along with ease and convenience, online shopping can offer plenty of opportunities for thieves and scammers to steal your financial information.

Follow these tips to stay safe while shopping online:

Shop sites you know. Ensure you’ve typed in the URL correctly or use a link you’ve used safely in the past. Watch for misspellings that can take you to a fake look-alike site. When shopping at a new vendor, look for the physical address and phone numbers on the site in case you need to contact them. You can also quickly search to see if the site is legitimate.

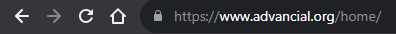

Check for encryption. Before entering your credit card information, make sure the site is encrypted. The URL should begin with “https” – not just “http” – indicating secure sockets layer encryption. A closed padlock icon should also be in front of the URL or on the lower section of your browser.

Use a credit card. Credit cards generally limit liability for fraudulent charges. Debit cards may provide some protection, but while you’re waiting for a dispute to be settled, your checking account may already be drained by thieves. Consider using a dedicated credit card for online shopping and another card for other uses. If your online card is hacked, you still have access to another card while your complaint is being investigated.

Use strong passwords. Don’t reuse the same password at different sites. Make sure your mobile phone is password-protected in case it’s lost or stolen. If available, use biometrics, such as face recognition or fingerprint access, as an added layer of protection.

Don’t overshare. Online shopping sites need your payment information, billing and shipping addresses, email addresses and phone numbers. However, they should never ask for personal identification numbers (PINs), bank account information or Social Security numbers. Be cautious of any email that requests personal information and provides a link. If you have questions, contact the vendor directly from their website or by phone.

Avoid using public Wi-Fi. It’s best to do your shopping where you have secure access. Hackers may be able to intercept your information over unsecured Wi-Fi networks. Plus, in public places, low-tech scammers may simply look over your shoulder while you enter your credit card information.

Reconsider storing your credit card info on a site. Although it does make future transactions quicker, it is safer to re-enter your credit card information each time you shop online.

Use official apps. If you’re shopping from your mobile phone, connect from the official retailer app you’ve downloaded rather than from an email or social media link.

Keep antivirus software up to date. This will help protect your devices from viruses or other malware designed to gain access to your personal financial information.

Monitor transactions regularly. Don’t wait for your monthly credit card statement to review charges. cuAnywhere® Online Banking from Advancial makes it convenient to check your transactions at any time, so you can spot suspicious purchases and alert us immediately. If you need to dispute a transaction made with your Advancial debit or credit card, it’s easy to do online or via the Advancial Mobile App.

WE TAKE SECURITY SERIOUSLY

Advancial uses robust security protocols and continuously monitors our members’ accounts for suspicious activity. By working together, we can keep your online shopping experience safe and enjoyable.

Follow these tips to stay safe while shopping online:

Shop sites you know. Ensure you’ve typed in the URL correctly or use a link you’ve used safely in the past. Watch for misspellings that can take you to a fake look-alike site. When shopping at a new vendor, look for the physical address and phone numbers on the site in case you need to contact them. You can also quickly search to see if the site is legitimate.

Check for encryption. Before entering your credit card information, make sure the site is encrypted. The URL should begin with “https” – not just “http” – indicating secure sockets layer encryption. A closed padlock icon should also be in front of the URL or on the lower section of your browser.

Use a credit card. Credit cards generally limit liability for fraudulent charges. Debit cards may provide some protection, but while you’re waiting for a dispute to be settled, your checking account may already be drained by thieves. Consider using a dedicated credit card for online shopping and another card for other uses. If your online card is hacked, you still have access to another card while your complaint is being investigated.

Use strong passwords. Don’t reuse the same password at different sites. Make sure your mobile phone is password-protected in case it’s lost or stolen. If available, use biometrics, such as face recognition or fingerprint access, as an added layer of protection.

Don’t overshare. Online shopping sites need your payment information, billing and shipping addresses, email addresses and phone numbers. However, they should never ask for personal identification numbers (PINs), bank account information or Social Security numbers. Be cautious of any email that requests personal information and provides a link. If you have questions, contact the vendor directly from their website or by phone.

Avoid using public Wi-Fi. It’s best to do your shopping where you have secure access. Hackers may be able to intercept your information over unsecured Wi-Fi networks. Plus, in public places, low-tech scammers may simply look over your shoulder while you enter your credit card information.

Reconsider storing your credit card info on a site. Although it does make future transactions quicker, it is safer to re-enter your credit card information each time you shop online.

Use official apps. If you’re shopping from your mobile phone, connect from the official retailer app you’ve downloaded rather than from an email or social media link.

Keep antivirus software up to date. This will help protect your devices from viruses or other malware designed to gain access to your personal financial information.

Monitor transactions regularly. Don’t wait for your monthly credit card statement to review charges. cuAnywhere® Online Banking from Advancial makes it convenient to check your transactions at any time, so you can spot suspicious purchases and alert us immediately. If you need to dispute a transaction made with your Advancial debit or credit card, it’s easy to do online or via the Advancial Mobile App.

WE TAKE SECURITY SERIOUSLY

Advancial uses robust security protocols and continuously monitors our members’ accounts for suspicious activity. By working together, we can keep your online shopping experience safe and enjoyable.