Swim Carefree

We’re pleased you’ve chosen Advancial as your financing solution! Please take a moment to read the information on this before beginning your application. If prompted, enter code swimcarefree

Apply in Minutes

What You'll Need

Before applying, please be sure to have the following identification and information ready:

Important Information about Your Financing Request

Advancial membership is required to receive financing. You do not need to be a member in order to apply. If your financing application is approved, we will create your membership account at the same time. Minimum monthly payments are required. Subject to credit approval.

Before applying, please be sure to have the following identification and information ready:

- Valid, unexpired U.S. government (Federal or State) issued photo ID

- We will request that you upload a clear image of this during the application process

- Social Security Number

- Physical Address

- Email Address & Phone Number

- Employment & Income Information

- Invoice/Reference Number provided by your merchant (optional)

Important Information about Your Financing Request

Advancial membership is required to receive financing. You do not need to be a member in order to apply. If your financing application is approved, we will create your membership account at the same time. Minimum monthly payments are required. Subject to credit approval.

Important Credit Card Disclosures

Frequently Asked Questions about Advancial's Customer Financing Program

Minimum monthly payments are required. The minimum monthly payment is 3% of the financed balance.

Advancial is a credit union and per NCUA regulation, we must establish membership before extending credit to an applicant. Membership with Advancial is established through our basic savings account and is simultaneously opened with your financing. As long as the savings account remains open, you will be a member of Advancial for life.

You will also have access to our other products and services, and your immediately family members will be eligible to join Advancial as well.

You will also have access to our other products and services, and your immediately family members will be eligible to join Advancial as well.

We do not charge any annual fee, foreign transaction fees, or penalty rates on our Visa® Rewards Plus card. See disclosures above for more details.

Advancial will conduct a formal review of your credit. This is commonly referred to as a “hard” inquiry and is typically made by a lender when applying for a credit card.

Advancial uses Experian for credit reports.

Advancial is headquartered in Dallas, TX and has locations in several states. We also belong to the Shared Branch network which allows you to access your account through cooperative network of other credit unions.

Once your account is opened, you will receive information on how to setup online banking through our cuAnywhere® platform as well as our mobile app.

Once your account is opened, you will receive information on how to setup online banking through our cuAnywhere® platform as well as our mobile app.

Please contact the branch whose information is listed on this page.

No, this program is for consumers only.

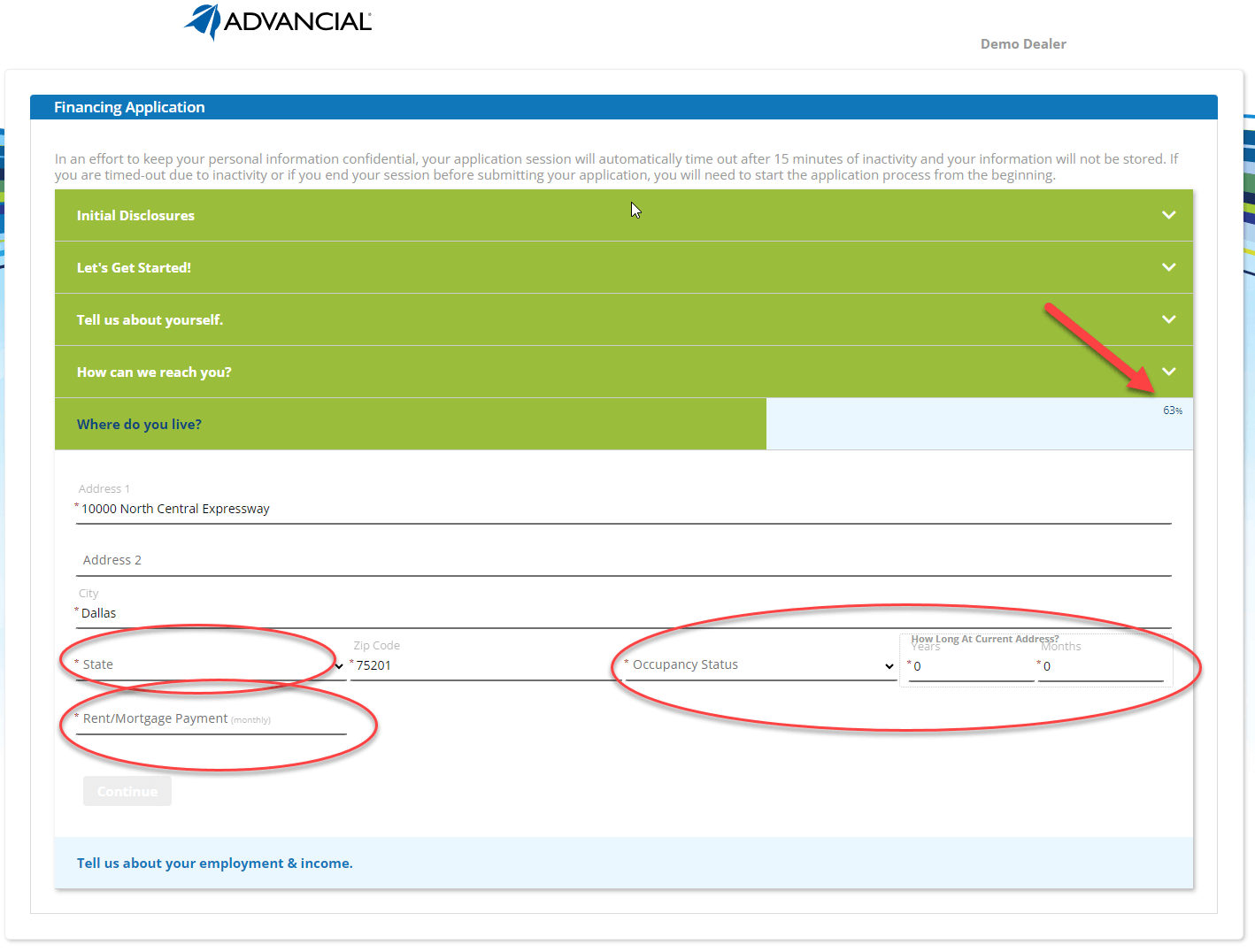

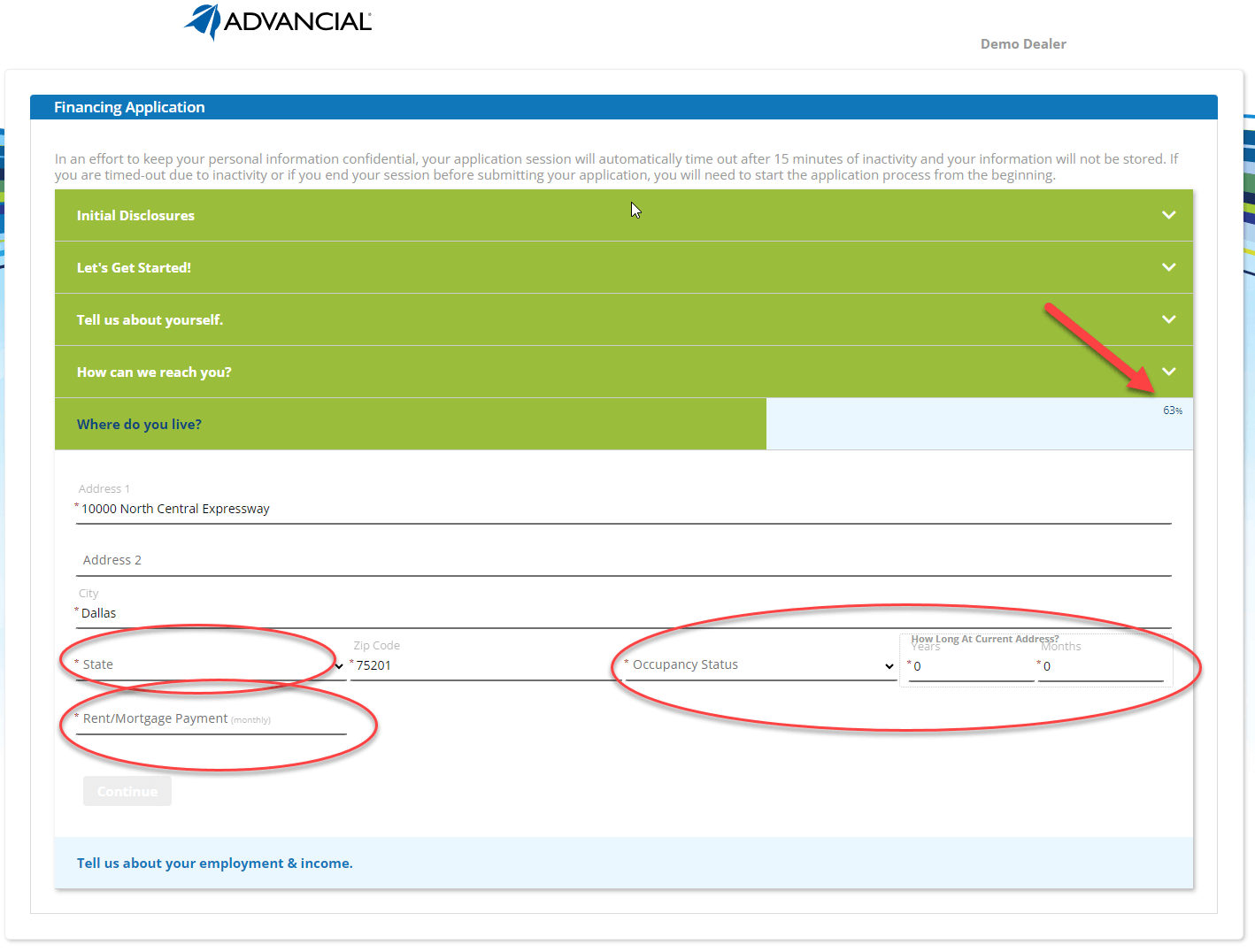

Most of the time, the Submit button doesn’t work because there is a required field that is not complete. All fields with an asterisk are required to be completed in order to submit the application. There is a green progress bar that runs along the top of each section that will move from left to right to show the amount of completion for each section.

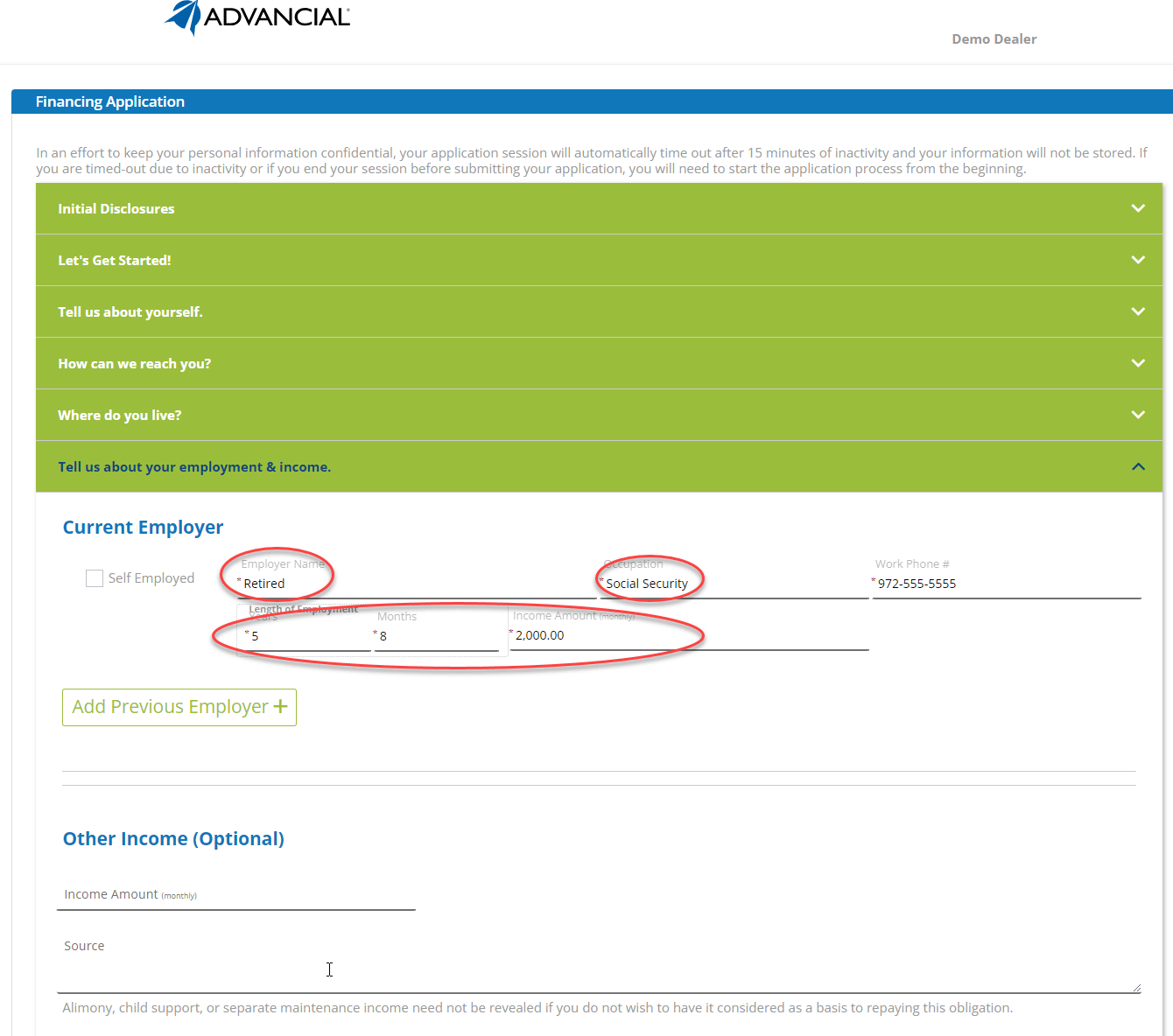

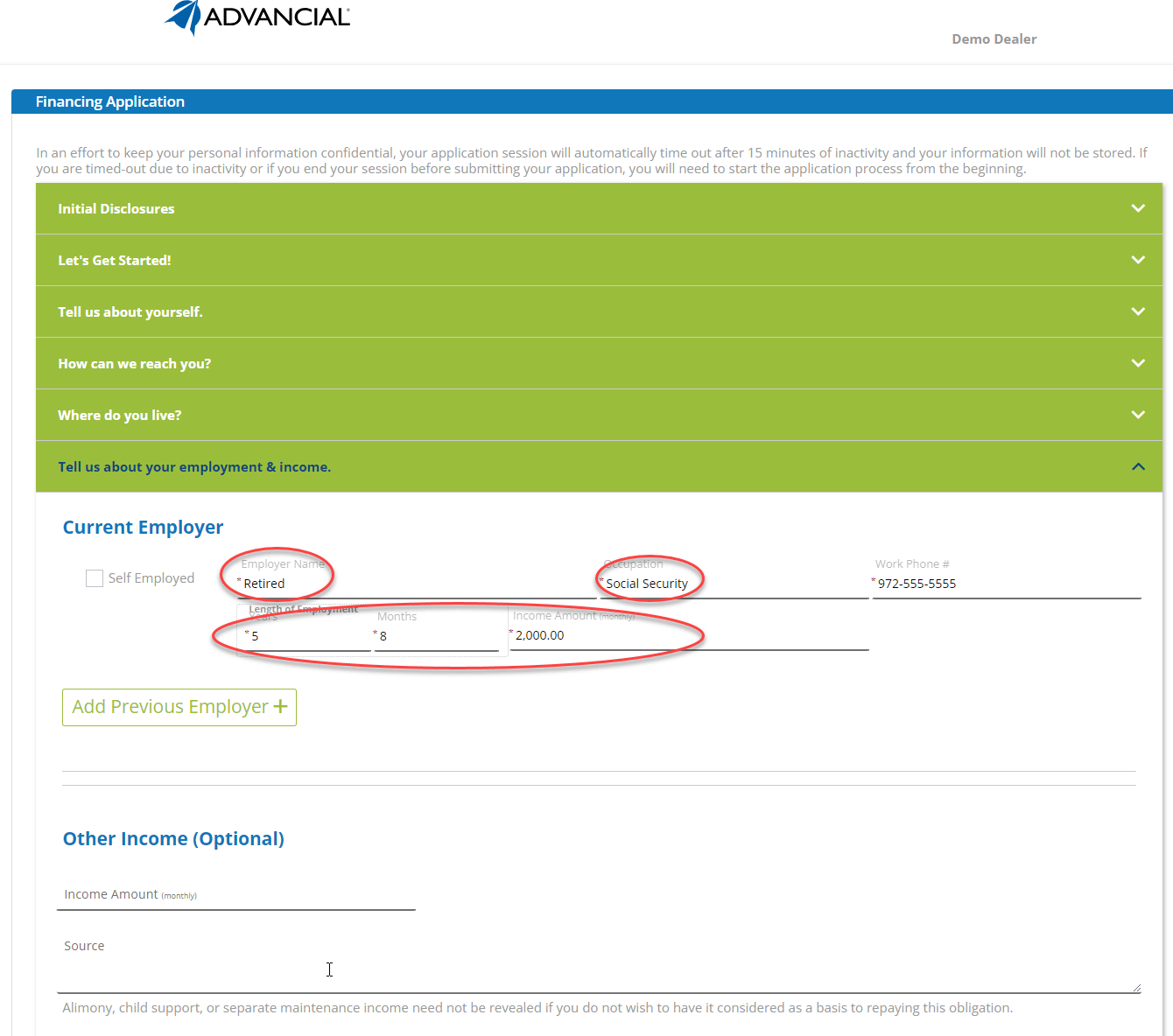

Many applicants to forget to fill in the "Months" field for Length of Employment, or even their work (or preferred) phone number. Below are examples of fields that are still incomplete; and would, therefore, not allow the application to be submitted.

Many applicants to forget to fill in the "Months" field for Length of Employment, or even their work (or preferred) phone number. Below are examples of fields that are still incomplete; and would, therefore, not allow the application to be submitted.

Below is an example of how to fill out the Employment and Income section of the online application for an applicant who is retired. Information inputted may be different than what is shown in the example depending upon that type of retirement income that applicant is receiving.

View Cardholder Agreement (PDF)

View Rates and Fees (PDF)

View Advancial Rewards Terms and Conditions (PDF)

View Rates and Fees (PDF)

View Advancial Rewards Terms and Conditions (PDF)

10% Credit Card Balance Transfer Terms and Conditions: Introductory balance transfer offer must be used within the first 12 months after account opening and is available for a single balance transfer request. Multiple balances from other non-Advancial Federal Credit Union accounts may be combined into a single 0% balance transfer request, but the balance transfers must be requested at the same time. If you do not pay off a 0% balance transfer balance within twelve months of the transfer, the remaining balance will then be subject to the Standard Rate. Balance transfers performed after the initial introductory offer will incur the same APR as the account and will incur a 3% balance transfer fee, unless otherwise stated in a separate promotional offer.